Clik here to view.

When Richa Kar and Kapil Karekar took the bold step to enter the little-promoted and largely untapped lingerie market with Zivame, they quietly transformed how women in India shopped for innerwear. It started in 2011 as an online aggregator of well-known lingerie brands like Enamor, Amante and Jockey, became a private label business by 2016 (in-house brands were launched since 2013) and was acquired by Reliance Retail (RRL) in 2020 for $160 Mn.

Zivame (Actoserba Active Wholesale Pvt. Ltd) has set women free from the ordeal of in-store lingerie purchases, providing a hassle-free online shopping experience and a good fit-finder. But breaking the mould could not save it from the turbulence that followed its initial success. By FY16, it struggled to cope with dwindling growth while net losses piled up. After Kar’s departure in 2017 and multiple leadership changes, the company is finally on the path to profitability under the guidance of Lavanya Pachisia, Zivame’s chief operating officer.

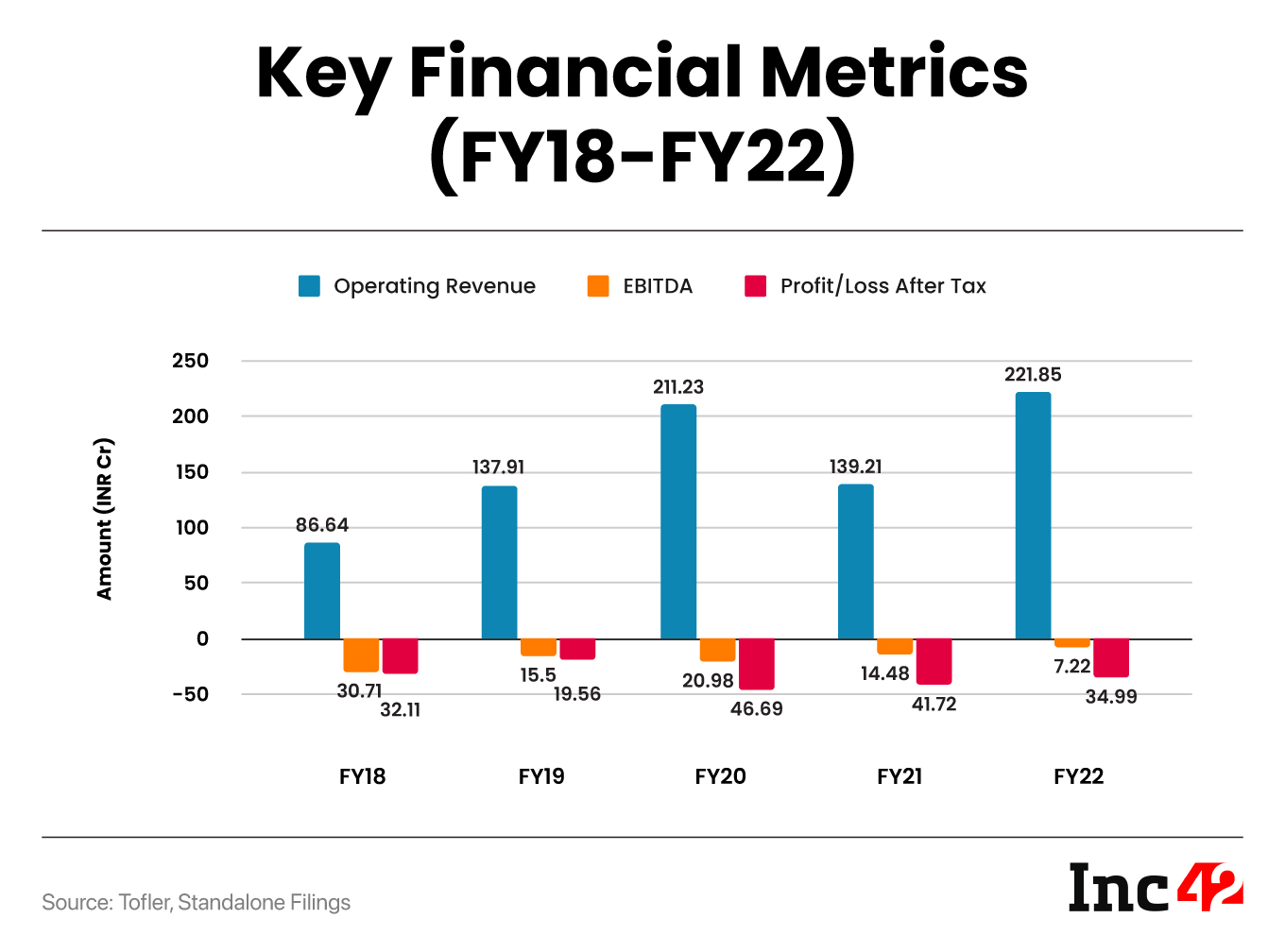

For starters, the brand lowered its YoY losses by 10.64% and 16.13% in FY21 and FY22, respectively. In FY22 (ended March 2022), it also generated an operating revenue of INR 221.85 Cr, its highest so far, as the FY23 (ended March 2023) numbers are not out yet. However, in a recent conversation with Inc42, Pachisia disclosed that all its sales channels (online and offline) were profitable in FY23.

“The brand recorded 150% revenue growth post-Covid (FY2022-2023), with its offline expansion playing a significant role, especially in Tier II markets and beyond,” she added.

For perspective, RRL set up 3.3K new stores in FY23, taking the total number of its retail outlets to a little over 18K, two-thirds of which are in Tier II and III locations. The company’s drive to make retail thus inclusive and omnichannel is understandable as it aims to reach the next billion people (even those without internet access) who are just entering the traditional consumer market. Brands like Zivame under the RRL are bound to gain from this business focus as the retail giant works on online-to-offline expansion through all possible touchpoints.

Additionally, Reliance Brands (an RRL unit partnering with global luxury brands) has helped expand Zivame’s retail footprint across large format stores and premium venues with high real estate costs. According to Pachisia, the smaller brand might have faced challenges accessing these markets, but collaboration with Reliance Brands has helped establish its presence in high-end markets.

In essence, the lingerie brand’s exposure to premium and mass markets across formats has given it a huge head start in clearing the omnichannel hurdle that often trips up competitors.

“Historically, Zivame operated as a digital-first brand, primarily functioning from Zivame’s own website and selling through marketplaces, thus upholding its retail presence. But there has been a significant development in the past two to three years [post its acquisition]. Zivame has set up more than 170 proprietary retail stores, from its earlier count of fewer than 50. This marks a substantial expansion in our retail footprint,” said Pachisia.

Image may be NSFW.

Clik here to view.

Decoding Zivame’s Omnichannel Growth Strategies

Women’s innerwear has traditionally been a largely unorganised sector, marked by the prevalence of local brands and a spattering of international players like Jockey, Enamor, Calvin Klein and H&M. But of late, the Indian market is growing exponentially, as lingerie is no longer considered a piece of essential clothing but part of self-expression, body confidence and a fashion statement of sorts. The market size was around $4.4 Bn in 2022 but is estimated to reach $8.2 Bn by 2028, growing at a CAGR of 10.9% during 2023-2028.

Akin to other direct-to-consumer (D2C) categories, much of this growth is driven by new and existing shoppers willing to trade up and improve their lives. Therefore, the Zivame team has recognised the imperative of staying aligned with consumer presence at every touchpoint, said Pachisia. Over the past three years, the brand has cultivated its capabilities and fortified its visibility online and offline to establish a distinct market identity.

Nevertheless, ensuring well-coordinated online and offline sales requires a delicate balance.

Zivame’s online sales account for 60-70% of its transactions. This is because online shopping generally results in higher units per transaction (UPT) and better AOV (average order value), roughly 3x more than in-store purchases. On the flip side, returns mainly occur when people buy online, while customers tend to try products in-store before making a purchase. Even the percentage of online returns may be lower than 15%, as many customers prefer exchanging the goods instead of returning them. Simply put, optimising and managing every sales format is critical for driving growth and profitability.

To achieve this goal, the brand (in its new avatar) has explored and adopted various measures that strike a chord with all customers, whether they are online or offline, experimenting with products, buying voguish things or going with trusted voices (trained offline staff helping women with their purchases).

Here are the key growth strategies Zivame is leveraging to drive omnichannel growth.

Creating The Right Lingerie Line

Innovation is the key. Understanding the fast-evolving needs of consumers and making them aware of how a brand can help are the two major challenges for D2C brands. According to Pachisia, women struggle to pick lingerie due to unsuitable fabrics, size misfits and zero privacy when these are sold offline. However, Zivame is constantly innovating its product range, aiming to provide comfortable intimate wear for women of all sizes, shapes and ages, she added.

For instance, when the company launched True Curve, it was a distinct product line designed for curvier women. The Miracle series uses exceptionally lightweight fabric, offering a sensation akin to a second skin. Among other specialised products, Zivame has created mastectomy bras to cater to breast cancer survivors. During the team’s research, the brand found that Indians usually consider cotton a safer choice for their skin in a hot and humid climate. Hence, products have cotton interiors (the part in direct body contact) complemented by polyimide exteriors for a sleek finish.

Recognising the desire for a great fit and affordability among Indian women, Zivame has introduced the Rosaline range, which provides comfortable, well-fitting innerwear at great prices.

Differentiation for inclusivity is the goal. Gone are the days when women used the ubiquitous white in traditional sizes. Body inclusivity is the rule of lingerie play and products are now designed for all stages of life. It was not the case when Zivame was set up 12 years ago, as it initially targeted modern working women. But the brand has now invested in technology to determine the ‘right fit’ for various life stages – teenage, college-going, marriage, pregnancy, nursing and menopause.

Online shoppers need to answer a number of questions to find their ideal fit. An algo at the backend does it for them. Plus, the more the data, the smarter it becomes, and suggestions become even more accurate. Besides this crucial differentiator, Zivame has developed a breadth of sizing to meet unique requirements.

“More than 70% of women do not wear the right size,” emphasised Pachisia. “Zivame is one of the pioneers in addressing this issue and offers an extensive range. It can be as small as 28 and as large as 50. You even also get something as rare as 34.5. This is a capability traditional players often lack.”

Category additions attract users. Zivame has diversified its offerings to include sleepwear, activewear, office wear, shapewear and more. Its strategic expansion resulted in a notable 25% increase in repeat business, said Pachisia.

Keeping Tabs On Operations To Maximise Growth

Technology, local production drive cost advantages. Escalating costs of raw materials, manufacturing and fuel pose challenges for clothing brands, creating a dent in gross margins and hindering expansion. To counter this, Zivame adopted a two-pronged strategy.

First, it has shifted most of its manufacturing operations to domestic facilities, a departure from its earlier centralised approach. As Pachisia explained, with the Make in India initiative they have moved it to manufacturing in India with more vendors, as opposed to a few vendors earlier outside of the country. Its warehouses (on lease) are also spread across the country to ensure quick delivery in Tier II and III locations.

Then again, the brand has embraced advanced technology to broaden its user base and enhance the shopping experience on the app. These innovations have made the lingerie line popular and helped reduce customer acquisition costs (CAC). The company also leverages data and metrics to reassess its marketing efforts, focussing on targeted approaches to reach the most profitable customer segments.

A distinctive advantage for a digital-first brand, or one that has transitioned from digital-first to omnichannel retail, lies in the abundance of available data and the subsequent analyses allowing them to discern consumer pain points and requirements. This data-driven approach has also helped Zivame determine good store locations, identify high-selling products and maximise profitability in brick-and-mortar outlets.

It makes the best of the seasonal boom. Big-time online events like the Flipkart Big Billion Days and Amazon Great Indian Festival have made ecommerce popular and accessible among the masses. Zivame launched the Grand Lingerie Festival online in 2018 in tune with this trend. And this year (2023) saw a strategic expansion of the same offline, marking the beginning of an omnichannel extravaganza. The biannual event has been consistently profitable, said Pachisia.

In-store Buying Made More Lucrative

Prices are the same online and offline. Online businesses find it easy to attract customers and grow the top line by offering huge discounts. Yet, knocking 10, 20, or even 50% off the price tag can kill ecommerce. After all, the dollars fall off the bottom-line profit for every discount a business offers.

Zivame, on the other hand, sticks to the concept of ‘true’ pricing over discounts, said Pachisia. It means whether a purchase is made online or offline, in a Tier I or a Tier II location, prices and discounts remain the same across all channels. Therefore, its online business is not losing more in margins than is permissible (which may or may not be compensated by sales volume), and profit margins remain uniform across all formats.

Channel expansion helps Zivame fire on all cylinders. Besides selling on its official website and app, the brand is now available on various digital platforms such as Amazon, Nykaa and Flipkart. It also runs standalone offline stores and is stocked in Reliance Brand outlets. Its offline retail footprint spans 57 cities in Tier I and II locations.

Pachisia further underscored the evolving preferences of Tier II women, noting a shift towards urbanised experiences and heightened digital awareness. “About 30-40% of our revenue comes from Tier II and III cities. A [retail] revolution is underway and we must be accessible to our customers wherever they prefer to shop. The line between online and offline shopping is becoming increasingly blurred,” she said.

Creating a safe space to talk & shop brings more customers. Indians still harbour a taboo when it comes to anything related to women’s underwear. Also, most lingerie brands fail to challenge longtime industry norms, and the female perspective is often missing from the product range, be it material, comfort or fit. (Think of the size zero fanatics or how a global brand like Victoria’s Secret refused to feature plus-size models until 2018.)

Pachisia says that Zivame is committed to breaking such taboos by fostering conversations and incorporating those into brand messages, campaigns and offline store operations. For instance, these stores steer away from an open-design concept and provide safe and covered spaces for women.

Moreover, all sales personnel are women, extensively trained to comprehend the diverse requirements of shoppers without judging anyone for their body type or personal choice. This approach creates a secure environment for customers who can easily share their preferences and needs.

Image may be NSFW.

Clik here to view.![How Lingerie Brand Zivame Is Cracking The Omnichannel Code Post Reliance Acquisition]()

Can Zivame Help Women Love Themselves Inside Out?

Following its acquisition, Zivame has added all essential components to the brand’s journey to adopt a profit-oriented perspective. Its mantra is to achieve growth with profitability, prompting the team to enhance its business model and overall process sustainability. The company will continue to expand its offline presence to strike an online-offline revenue ratio of 50:50 instead of the current 60:40.

The only glitch: Reliance houses many prominent lingerie brands (Clovia, Zivame, Amante, Hunkemöller and more). Some industry experts think it may result in market cannibalisation and the inevitable killing of a few brands.

Pachisia did not think so, saying all brands under the parent and they are trying to maintain that position as a group.

The COO asserts that the intimate wear category is one of the fastest-growing, generating significant buzz. Despite a largely unorganised market minus best-in-class manufacturing standards and age-old taboos limiting the freedom to dress as one likes, new-age players like Zivame are crucial in educating women about the importance of wearing the right fit and looking good, irrespective of age or size.

“Zivame will continue to invest in consumer education because, as a brand and a category leader, we bear the responsibility of guiding consumers towards the right fit and addressing common challenges. The market is vast, with room for more players to enter. We are just scratching the surface and there’s more potential ahead,” said Pachisia.

The brand makes an insightful case study featuring business model pivots, investor-founder conflict and a narrative showcasing rise, fall and rise from the brink. Now that it endeavours to emerge as a leading brand in a growth sector, it is time to watch how Zivame copes with future challenges and helps women choose their lingerie beyond the traditional.

[Edited by Sanghamitra Mandal]

The post How Reliance Owned Lingerie Brand Zivame Cracked The Omnichannel Code appeared first on Inc42 Media.